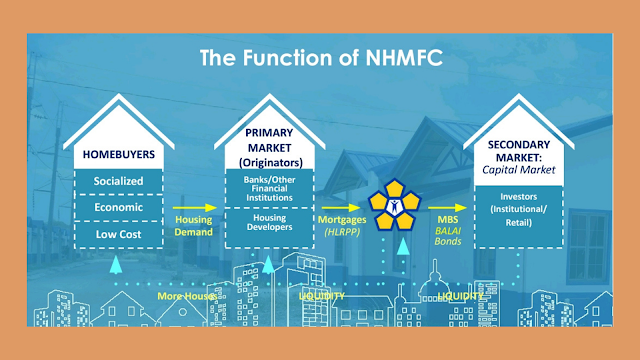

National Home Mortgage Finance Corporation is the pioneer in the development of the secondary home mortgage market. Under Presidential Decree No. 1267 (December 21, 1977, Charted and Mandate), NHMFC develops and provides for a secondary home market, charged with the development of a system that will attract private institutional funds into long-term housing mortgages.

- Fixed Rates

- Fast Processing Time

- No Membership Required

- High Loan to Value Ratio

- No Pipeline Quota

1. Location

National Home Mortgage Finance Corporation is located on the 2nd Floor, RD South Sea Building, Corner Magsaysay Avenue, Corner Salazar St., Magsaysay Ave, General Santos City. The Qualified Originators in the said agency are the following:

- Housing Developers

- Micro Finance Institutions

- Cooperatives

- Rural or Thrift Banks

- Private Corporations

- Government Agencies

- NGA Accredited Civic Organizations

2. Housing Loan Receivables Purchase Program (HLRPP)

NHMFC has its housing loan program and they called as NHMFC Housing Loan Receivables Purchase Program (HLRPP). The said program is a vehicle to implement the Securitization Program. Under HLRPP, NHMFC buys housing loan receivables with residential houses or condominiums originated by banks, developers, LGU's, cooperatives, and other financial institutions.

There are four HLRPP available, namely Home Program (HLRPP1), Shelter (HLRPP2), Reverse Mortgage Program (HLRPP3), and Balai Berde (HLRPP4).

A. Home Program (HLRPP1)

PURCHASE OF ORIGINATED ECONOMIC/LOW-COST HOUSING RECEIVABLES OR HOME PROGRAM is a housing finance program that aims to purchase valid housing loans receivables originated by banks, housing developers, cooperatives, etc.

I. Types of loan

- Contracts to Sell

- If the account is up to 2,000,000, the hold-out rate is 7.5%.

- If the account is over 2,000,000, the hold-out rate is 10%.

- Real Estate Mortgage

II. Terms and Interest

- Up to 30 years

- Maximum aged 70

- Based on loan term and Originator's Criteria Rating (4.7%- 6.3%)

|

7 Years |

10 years |

15 years |

20 years |

25 years |

30 years |

|

4.7% |

4.8% |

5.2% |

5.5% |

5.9% |

6.2% |

III. Loan Amount

- Loan up to Php 3,000,000

IV. Loan to Value Ratio and Equity Requirement

- 90% LTV

- At least 10% Equity Requirement

- With seasoning requirement of 6 mos to 12 mos

B. SHeLTeR (HLRPP2)

I. Types of loan

- Contracts to Sell

- Hold-out rate is 6%.

- Real Estate Mortgage

II. Terms and Interest

- Up to 30 years

- Maximum aged 70

- 3% in the First 5 years and 5.5% in the succeeding years.

|

5

years |

Remaining

Years |

|

3% |

5.5% |

III. Loan Amount

- Up to Php 580,000 for socialized subdivision projects

- Up to Php 750,000 for socialized condominium projects

IV. Loan to Value Ratio and Equity Requirement

- 100% LTV based on Socializing Housing Pricing

- No Equity Requirement

- No seasoning requirement

C. MABUHAY (HLRPP3)

I. Loan Term

- The loan term is based on the life expectancy minus the age of the borrower at the time of the application.

- Male: 74 years old

- Female: 81 years old

Loan Term = Expectancy Age | Interest Rate |

Male - 74 years old Female - 81 years old | 4.0% |

II. Loanable Amount

- 60% of Property Value but shall not exceed 5 million.

D. BALAI BERDE (HLRPP4)

I. Terms and Interest

- Up to 30 years

- Based on loan term and Originator's Criteria Rating (3%-6%)

|

5

to 15 years |

16-25

years |

26-30

years |

|

3.0% |

4.5% |

6.0% |

II. Loanable Amount

- Purchase Price of Loan Receivables = Outstanding Principal Balance

- Loan amount up to 100% of the Appraised Value not exceeding Php 3,000,000

3. Conclusion

Not only PAG-IBIG but there are also Government Agency that offers housing loan for everyone such as NHMFC. For more details, visit your nearest NHMFC.

Disclaimer: Those programs is still running but subject to changes without prior notice. Visit their official website for more info.

.png)

0 Comments