CONSIGNMENT SALES(Quick Notes)

A consignment constitutes the transfer of possession of merchandise without the transfer of title from the owner, called the consignor, to another person, called the consignee.

-shipment

of goods to the consignee is not treated as a sale.

-revenue

is recognized after the consignor receives the notification of sales and the cash

remittance from the consignee.

Advantages

1. Wider markets for a product

2. Control over selling price

3. Recovery of an asset

Reasons why consignment is attractive

1. Compensation

2. Reimbursement for Advances and Necessary Expenses

3. Granting of credit

4. Warranty of Consigned Goods

Responsibilities of the Consignee

1. Care and protection of the consigned goods

2. Identification of consigned goods and receivables.

3. Due care in granting and collecting receivables

4. Timely periodic reporting of sales and collection

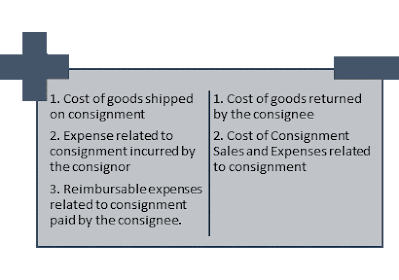

Accounting by the Consignors

-Any

reimbursable expense paid by the consignee is charged to a receivable account

by the consignee and added to the balance by the consignor and added to the

balance by the consignor.

1. Consignment transaction recorded separately

|

Inventory on Consignment

|

2. Consignment transaction not recorded separately

Accounting by the Consignee

· Maintain records and controls that permit the

identification.

a. Goods Held on Consignment

b. Related Receivables and Reimbursable expenses;

· Prepare periodic reports

1. Consignment transaction recorded separately

|

Consignor Receivable

|

|

Consignor Payable

|

.png)

0 Comments