LONG-TERM CONTRACTS (A QuickNotes)

A construction contract is a contract specifically negotiated for the

construction of an asset or a combination of assets that are closely

interrelated or interdependent in terms of their design technology, and

function, or ultimate use or purpose.

Types of Construction Contracts

1.

Fixed

price Contract

·

Agreed to a fixed price

·

Subject to cost escalation clauses

2.

Cost

Plus Contract

·

Reimbursed for allowed or otherwise defined

costs plus a % of these costs or a fixed fee.

Construction Revenue- the total amount of consideration receivable

under the contract.

Variation- instruction by the customers for a change in the scope

of the work to be performed under the contract.

Incentive Payment- additional amounts paid to the contractor are

specified to be met or exceeded.

Claims- an amount that the contractor seeks to collect from the

customers or another party as reimbursement for costs not included in the

contract price.

Construction Contracts

·

relate directly to the specific contract

·

Are attributable to contract activity in general

and can be allocated to the contract.

·

Chargeable to the customers

The cost that are direct:

1.

Site

labor costs

2.

Materials

used

3.

Depreciation

4.

Moving

PPE

5.

Hiring

PPE

6.

Design

and technical assistance

7.

Rectification

and guarantee work

8.

Claims

from third parties

A.

%-Completion

Method

·

An application of the accrual assumption

·

Avoids the mismatch between costs being

recognized as they are incurred and revenue only being recognized when the

contracts are completed.

I.

Input

Measures

·

Based on an established or assumed relationship

between a unit of input and productivity.

a.

Cost-to-cost

method- degree of completion is determined by comparing costs already

incurred with the most recent estimates of total costs expected to complete the

project.

b.

Effort-expended

Method- based on some measure of work performed.

II.

Output

measures- are measured in terms of results achieved. It was based on units

produced.

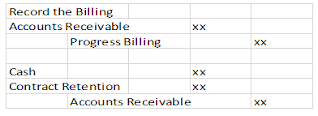

Financial Statement Presentation

Current Assets. Gross Amount due from Customers- It comprises the total cost incurred on the contract + cumulative recognized profit less

progress billings

Current Liability. Gross Amount due to Customers- Progress Billings

less total Cost incurred in the contract + cumulative recognized profit

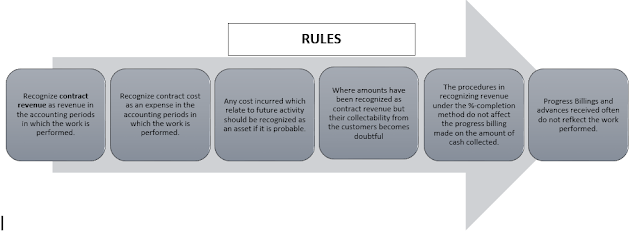

Cost-Recovery Method

1. Recognize

Revenue only to the extent of contract costs incurred in which are expected to

be recoverable;

2. Recognize

contract costs as an expense in the period they are incurred.

Financial Statements Presentations

Current Assets- Total costs incurred on the contract, less progress

billings

Current Liability- Progress Billings less total cost incurred on

the contract

General Administrative Expense- change to income in the period when

they occur.

Contract Retention- guarantee the completion of the contract in satisfying

manner (Current Assets)

.png)

0 Comments