Business Risk Management is risk management that assesses and addresses the risk involved in the operations, systems, and controls. It guides in making relevant decisions and has an immediate creation of a plan in case it has an emergency or an opportunity involved.

In this case, this article explains the application of the risk management system of Lincoln Electric Company. More details on Lincoln Electronics are in the link below (Harvard Business Review): https://hbr.org/1999/05/lincoln-electrics-harsh-lessons-from-international-expansion

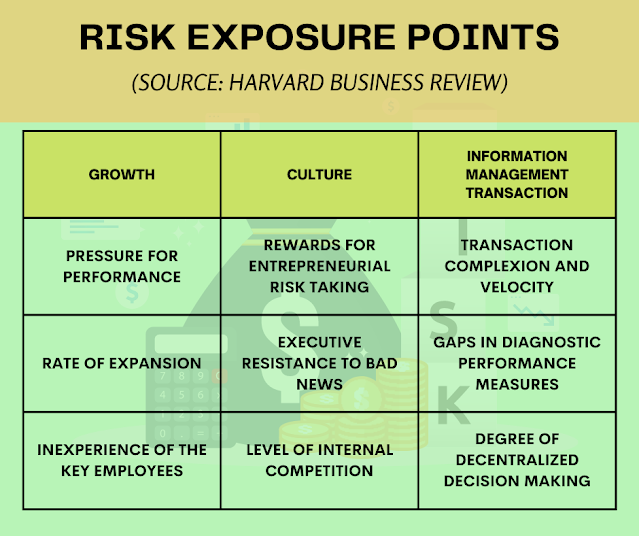

A. In his article “How risky is your business?” Simons proposes a diagnostic tool called the “Risk Exposure Calculator”. Using the Lincoln case study, identify where you think Lincoln would have scored in relation to its offshore expansion and early management of the offshore businesses against the nine pressure points with supporting reasons.

- Pressure for Performance- It is when they establish a good incentive system which it was based on how many units they produced.

- Rate of Expansion- It is when CEO Willis spent a huge amount of the entity’s money to build greenfield plants and buy operations in other countries. Some countries they made in, such as Spain, suffered an economic recession.

- The inexperience of Key Employee- It is when Ted assigned Mr. John Gonzales to supervise European Factories. He had no knowledge or experience in managing them, especially in sales and marketing

- Rewards for Entrepreneurial Risk-Taking- It is when Lincoln Electronics made battle with ESAB, a manufacturer and competitor of arc-welding products based in Sweden, who built their midsize manufacturer in their area, hence, Lincoln Electronics took risks and made some ways very quick to compete with them.

- Executive Resistance to Bad News- The CEO had only a minimum involvement so a low chance of knowing some problems of the company.

- Level of Internal Competition- When the basis of the bonus was changed to the employees’ performance, ignoring the productivity and quality

- Transaction Complexity and Velocity- It is when they expanded internationally so many transactions were being created and monitored.

- Gaps in Diagnostic Performance Measures- The more they expanded, the more they missed their targets, and nobody knew how to solve it until the gaps were getting bigger.

- Degree of Decentralized Decision-Making- Their subordinates followed and listened to their managers even though they skip some procedures since the managers insisted on them.

Based on the nine-pressure given, the Rate of Expansion has the highest point, indicating a high maximum amount of risk. They thought that expanding its operations lead to be successful. They are aggressive in their expansion and do not consider the geographic location of each country.

B. Simons asserts that his levers of control framework addresses “internal” rather than “external” risk exposure. Do you agree? Is it useful to distinguish between internal and external risk exposure in understanding how risk is managed?

Yes, I agree. Simon’s Levers of Control addresses the internal aspect of the organization since all the decisions are made within the entity and by the top management level so the scope of risk exposure will also follow.

It is very important to

distinguish the source of risk (internal and external) because the approach in

eliminating or controlling them is different. Internal risk will be controlled

or eliminated through the management decision and/or change of the process of

internal control, while external risk will be controlled/eliminated both by an

entity or outside parties such as a regulatory agency and consultant.

C. Birkett argues that “The creation of control structures in an organisation is a deliberate process involving trial and error, fine tuning, and the need to address constant change” (p2). Why do you think that this is the case?

Every business has its internal control where the operations of the

organization are based on it. Control structure contains control strategies and

those control strategies contains risks. Control Risks both internal and external

cannot be eliminated but it can be lessened. They undergo a deliberate process

and constant change using proper

planning and trial and error method. There are no ways to eliminate control

risks. If they make a control structure where it results in the desired output

effectively and efficiently, control risks will be lessened.

D. What according to Birkett (p8) is the role of control systems in the process of risk management?

The function of a control system in the process of risk management is to help the entity design and implement a control based on their control strategies made. It is an extension of control strategies that assists in minimizing the control risks. It also determines if the control strategies are effective or not and efficient or not by checking the result if it is overapplied or underapplied then the entity will think of another strategy to optimize those risks.

E. Birkett argues that “The creation of control structures in an organisation is a deliberate process involving trial and error, fine tuning, and the need to address constant change” (p2). Why do you think that this is the case?

Every business has its internal control and the operations of the

organization are based on it. Control structure contains control strategies and

those control strategies include risks. Control Risks both internal and external

cannot be eliminated but they can be lessened. They undergo a deliberate process

and constant change using proper

planning and trial and error methods. There are no ways to eliminate control

risks. If they make a control structure where it results in the desired output

effectively and efficiently, control risks will be lessened.

F. What according to Birkett (p8) is the role of control systems in the process of risk management?

The function of a control system in the process of risk management is to help the entity design and implement a control based on their control strategies made. It is an extension of control strategies that assists in minimizing the control risks. It also determines if the control strategies are effective or not and efficient or not by checking the result if it is overapplied or underapplied then the entity will think of another strategy to optimize those risks.

G. Birkett contends that control structures may be deliberately established or may emerge over time. Using the Lincoln case study describe how a revised control structure emerged from the problems with the overseas expansion, rather than being deliberately established initially?

It is better to have a revised control structure rather than deliberately

established initially because it is cost-effective, practical, and holistic.

Using, adapting, and selecting controls in a certain country that results in a

positive result and aligning them in a country with more risk exposure might

help them reduce. Based on Lincoln’s case, they should make some different

control structure for each country and if a certain country has a maximum risk

or ineffective control risks, they may use and align it to another country's

cost structure.

H. Explain how risk treatment relates to risk appetite. Describe Birkett’s five options in managing risk (risk treatments). Give an example how each treatment might be achieved.

Risk treatment relates to risk appetite since they are both helping to minimize the risks but there are some differences. Risk appetite explains the risk decided by an organization usually it is documented whereas risk treatment measures to lessen its risks.

There are five options for managing the risks.

- Avoidance is done by ignoring activities that lead to risk exposure. For example: In life insurance, smoking cigarettes because avoiding it may cause a withdrawal effect to that person which lessens risks in both financial and health.

- Retention is the way to accept and acknowledge the occurrence of risks. Usually, it is used to offset the cost with its benefits. For example: When you opt to lower premium health insurance, it also leads to a higher deductible rate.

- Sharing risk is when you share the risk of others, hence, it reduces the risk. Usually, it is implemented by using employer-based benefits that allow the entity to shoulder a portion of insurance premiums with its employee.

- Transferring is when you transfer the risk to others. The risk is not eliminated but might be reduced because if you transfer the risk, another type of risk will creating. For example, Financial risks in connection with health care can be transferred from the individual as its source to its insurer.

- Loss Prevention and Reduction make an effort to minimize the loss rather than eliminate it. Usually, they will use preventive measures/processes. For example- Preventative Care in Health Insurance.

.png)

0 Comments